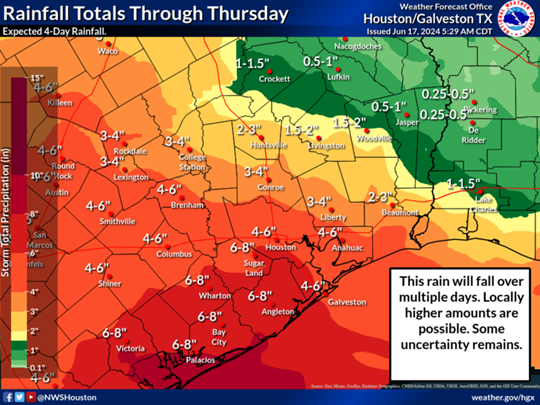

Fort Bend County Levee Improvement District No. 2 (LID 2) is actively monitoring Tropical Storm Beryl in the Gulf of Mexico. Beryl is expected to make landfall as a Hurricane on Monday, July 8, and the latest forecast from the National Weather Service is included below. The probable path of Beryl includes LID 2, with a 30-40% probability of tropical storm force winds of 39 mph. Rainfall forecasts vary, but the District is expected to receive 4-7 inches of rain from the outer bands of the storm. Fortunately, the Brazos River has dropped to levels that do not impact drainage inside the LID 2 levee. Based on the current forecast, the District does not anticipate that the pump stations will be operated, but operators are on stand-by if the forecast changes. LID 2 residents can monitor local conditions online at https://www.fbclid2.com/emergency/.

During any heavy rain event there may be street ponding or flooding if the storm drains are overwhelmed and back up. As rainfall decreases, the storm sewers will catch up, and any water in the streets will recede. Never drive into high water.

National Hurricane Center

National Weather Service